Why Health Insurance?

Today technology is available to cure critical illnesses as well as basic health concerns. But, with this advancement comes the shooting prices of health care services which are beyond the reach of common man. Here, health insurance comes as a relief to rescue us in the difficult times of hospitalization. This includes in-patient treatments, pre and post hospitalization charges, day care procedures, domiciliary treatments, etc.

Top Reasons to Buy Health Insurance Plans

Corporate Health Cover is Insufficient

With rising medical costs, the importance of health insurance policy cannot be overstated. Check the cost of a two day’s hospitalization for a regular ailment and then compare it with your company’s insurance coverage. When you will retire or change a job, your corporate health plan will cease to exist. So it is worthwhile to buy an individual health plan.

Increase in Incidence of Life Threatening Diseases

Sadly, India is grappling with life threatening diseases. The effect of these diseases is felt on the productive workforce from 35-65 years. Also, heart diseases among Indians occur five to ten years earlier than in any other population around the world. Sedentary lifestyles lead to life-threatening diseases like cancer and heart diseases which are critical and impose heavy expenditure burden on families. It is therefore imperative to insure oneself timely. Moreover, health insurance policies offer annual health checks ups to encourage health awareness.

Tax Benefits

You can get exemption for paying the premium under Section 80D of the Insurance Act. This year, India’s Finance Minister Mr. Arun Jaitley has increased the limit of deduction in health insurance premium to Rs 25,000 from Rs 15,000. For senior citizens, the new limit is Rs 30,000.

Better Financial Planning

We often set goals and save regularly to meet those goals but a medical emergency may play havoc in an individual’s financial planning. With Health Insurance policy, you may be rest assured of attaining your financial goals.

Value for Money

New health plan cover you for day care procedures and OPD, not just serious hospitalization. Depending on your level of cover, a health policy helps you pay for services such as ambulance, day-care procedures in addition to a number of non-hospital related services such as chiropractic, dental, physiotherapy, optical, dietary advice and some alternative therapies like Ayurveda and Homeopathy as well. .

Young buyers get a more comprehensive deal

Buying health insurance at a young age ensures there is no scope for pre-existing diseases as you will be covered early, and any diseases diagnosed later will be covered automatically.

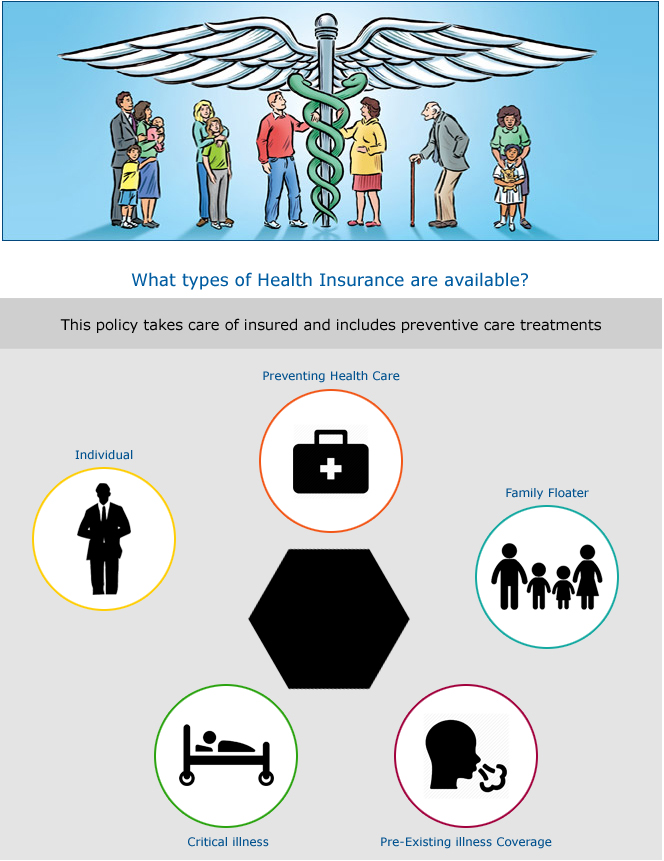

Individual Plans

Health insurance covers medical expenses for illnesses, injuries and conditions. But, unlike a plan through an employer, individual health insurance is something you select and pay for on your own.

Family Floater

A family floater health insurance, as the name suggests is a plan that is tailor made for families. It is similar to individual health plans in principle; the only difference is that it is extended to cover your entire family.

Senior Citizen Health Insurance

Senior citizen health insurance plan is a necessity, especially when you are planning to retire and live on pension or interest income from savings.

A sudden medical emergency can result in a financial crisis. To avoid this, it is prudent to take a comprehensive senior citizen mediclaim insurance policy. These senior citizen health insurance policies are for people aged between 65 years and 80 years.

Critical Illness

Life threatening critical illnesses like paralysis, cancer, heart diseases, brain tumours, not only leave the patient unable to earn but are also very expensive in nature. Many families get devasted financially and emotionally. A critical illness policy covers the insured in the event of such cases.

Hospitalization is not required because diagnosis is enough to get critical illness benefits. The insured receives the entire amount at once

TPA – Third Party Administer

Insurance claims throughout are settled by the insured or third party administrator. In case of hospitalisation, whether cashless or reimbursement, your TPA would be your point of contact. Always contact your service provider for any claim request.

Network Hospitals

These are hospitals listed area wise, which are empanelled with your insurer to provide cashless hospitalization should the need arise.

Cashless Hospitalization

Your insurer will have a list of network hospitals which are covered to provide cashless treatment should there be hospitalization. The insured need not pay hospital bill once approved, as it is already covered.

Pre and Post Hospitalization

Before and after hospitalization, depending on the no. of days mentioned in the policy, the expenses are covered by the insurer.

No Claim Bonus

If the policy holder does not register any claims in the whole year, he is entitled to No Claim Bonus (NCB). This is provided to insured as a deduction in renewal premium amount or increased sum assured.

Health Check-up

Free Health Check –up facility is offered by some insurers if there are no claims registered, depending on the policy type.

Hospitalization is not required because diagnosis is enough to get critical illness benefits. The insured receives the entire amount at once

What is a Health Card?

A health card is a card that comes along with the Policy. It is similar to an Identity card with details like your policy no., policy validity, TPA nos. which can be very useful in case of medical emergency. This card entitles you to avail cashless hospitalisation facility at any of our network hospitals.

What documents are required for filing a claim?

Duly completed claim form

Original bills, receipts and discharge certificate/ card from the hospital

Original bills from chemists supported by proper prescription

Receipt and investigation test reports from a pathologist supported by the note from attending Medical practitioner / surgeon prescribing the test.

Nature of operation performed and surgeon's bill and receipt.

Do I get Tax Exemptions?

All health insurance policies are eligible for the Income Tax Exemption under Section 80D.

What are the eligibility criteria for purchasing Health Insurance?

(Need to verify this)

Can a person have more than one Health policy?

Yes. But each company will pay its rateable proportion of the loss, liability, compensation, costs or expenses.

E.g. If a person has Health Insurance from company X for Rs. 1 Lac and Health Insurance from company Y for RS. 1 Lac, then in case of a claim, each policy will pay in the ratio of 50:50 up to the Sum Insured.

What are Pre-Existing Diseases?

By Pre-existing Condition we mean any condition, ailment or injury or related condition(s) for which you had signs or symptoms, and / or were diagnosed, and / or received medical advice/ treatment, within 48 months prior to the first policy issued by the insurer

What do you mean by Pre and Post hospitalization?

Pre- and Post-hospitalization expenses cover all medical expenses incurred within 30 days prior to hospitalization and expenses incurred within 60 days post hospitalization provided the expenses were incurred for the same condition for which the Insured Personal's hospitalisation was required.

Is cashless facility available across all hospitals?

The cashless facilities are available only at the hospitals which are in our network.

In case of cashless treatments, in whose favour are cheques settled or who gets the payments?

The cheques are sent to the hospital to whom approvals for cashless are given.

What is Co-Payment?

Co-payment means a cost-sharing requirement under a health insurance policy that provides that the insured will bear a specified percentage of the admissible costs. A co-payment does not reduce the sum insured.

What is a Family Floater plan?

In a Family Floater plan all insured members are covered on floater sum insured basis. The sum insured for a family floater is our maximum liability for any and all claims made by all the insured members.

Why should I buy a critical illness cover?

With rapidly changing demographics and lifestyles prevalence of critical illness is on the rise in India. With rise in life expectancy and chronic nature of critical illness there is a requirement of additional funds to afford high medical costs for treating such critical illnesses. The insured member is compensated by a lump sum payment if there is a diagnosis of critical illness.

How do I select the appropriate cover amount?

The appropriate cover amount ought to be determined on the basis of the following factors:

Your age : Age is a critical factor for determining the cover since health risk increases with age.

Pre-existing / hereditary diseases : Pre-existing diseases are covered subject to sub-limits and waiting period. For example: A person whose parents suffer from Diabetes is more prone to the disease, so we recommend a higher cover at an early age so that the pre-existing disease also gets covered.

Moreover, also consider your financial status and lifestyle before selecting the coverage amount.

What do you mean by Pre and Post hospitalization?

Pre- and Post-hospitalization expenses cover all medical expenses incurred within 30 days prior to hospitalization and expenses incurred within 60 days post hospitalization provided the expenses were incurred for the same condition for which the Insured Personal's hospitalisation was required.

What are Network and Non-network Hospitals?

Network Hospitals

The company ties up with hospitals for cashless claim process. When you avail of a cashless treatment in any of these network hospitals, the company would settle the claim with the hospital directly. For a complete list of network hospitals, log on to Service Provider's or TPA's website. Hospital network list of each Service Provider or TPA may vary.

Non-network Hospitals

Non network hospitals are the ones with which the company does not have a cashless tie up. When you avail treatment here, you first settle the bills yourself and then submit the relevant documents and bills to the service provider or TPA. The amount, consequently, is reimbursed to you based on policy terms and conditions

What is Pre-Authorisation?

Pre-authorisation is basically an authorisation issued either by the insurance company or the service provider, specifying the value of the medical treatment that can be claimable under their insurance policy. To receive a pre-authorisation, you need to submit duly fill in the Pre-authorisation form.